Recent Search and Popular Product

Business Loan

Personal Loan

Home Loan

Education Loan

Car Loan

Credit Card

Loan Against Security

Loan Against Property

Credit cards are one of the best ways to increase a person's purchasing power. They also offer rewards on your spending, such as cashback and discounts. To maximize these benefits, you should compare different credit card offers before choosing the right deal for you. Let’s take a look at the features, benefits, and other important information about credit cards.

| Credit Card | Joining Fee | Minimum Required Income | Apply to get credit card |

|---|---|---|---|

| HDFC Bank Credit Card | Rs. 499 + GST. | Salaried - Rs. 20,000 p.m Self-Employed - 6 Lakhs p.a | Apply Now |

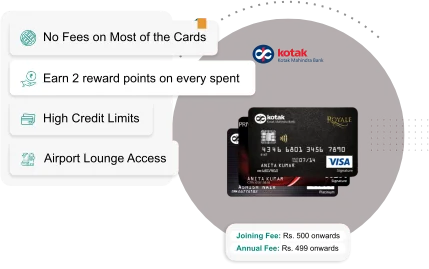

| Kotak Bank Credit Card | Rs. 500 onwards | Above Rs. 5 lakhs p.a | Apply Now |

| SBI Bank CardCredit | Depends on the Card Variant | Up to Rs. 3 Lakhs p.a | Apply Now |

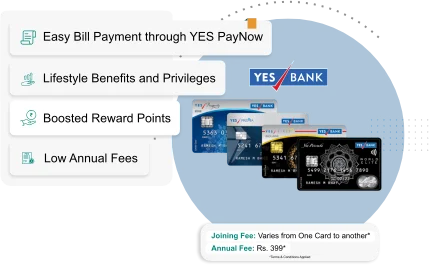

| Yes Bank Credit Card | Depends on the Card Variant | Salaried - Rs. 25,000 p.m Self-Employed - Rs. 41,666 p.m. | Apply Now |

| ICICI Bank Credit Card | Rs 500 + Goods and Services Tax (GST) | Up to Rs. 2.5 Lakhs | Apply Now |

| Standard Chartered Bank Credit Card | Depends on the Card Variant | Salaried - Rs. 27,500 p.m Self-Employed - Rs. 5 lakhs p.a | Apply Now |

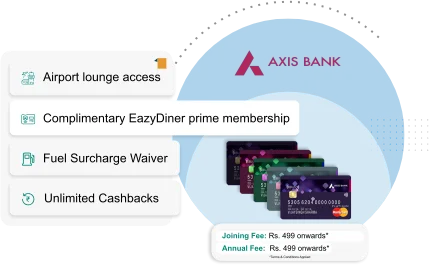

| Axis Bank Credit Card | Depends on the Card Variant | Salaried - Rs. 25,000 p.m Self-Employed - Rs. 6 lakhs | Apply Now |

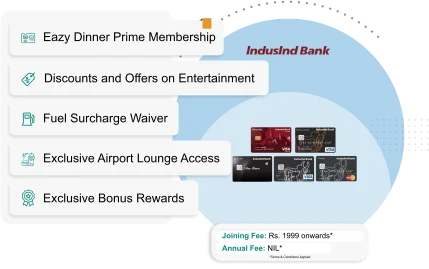

| Indusind Bank Credit Card | Depends on the Card Variant | Depends on the Card Variant | Apply Now |

| AU Bank Credit Card | Rs. 200 onwards | Depends on the Card Variant | Apply Now |

To know more about credit cards BY Bank? CLICK HERE

Required Documents

PAN Card

Aadhaar Card

Driving Licence

Voter ID

Passport

Registered rent agreement

Current passport size photograph

Salaried income documents

Self Employed person documents

Salaried income documents

-

Last 3 months' salary slip

-

Form 16 of last 2 years

-

Income Tax Return if any of last 2 Years

-

Last 3 months' bank statement if the salary directly credited in the bank account

-

Certificate of employment from current employer

Self Employed person documents

-

Income tax returns of previous 2 years

-

Statement of finances with a proper balance sheet with profit and loss in that sheet

-

Bank statement with continuity of business

-

GST registration evidence of business

Card to Card Documents

The documents required for a card-to-card application vary, but common documents include:

-

Government Issued Photo ID

-

Proof of Residency

-

Proof of Income

-

Applcation Form

-

Authorization to run a Credit Check (if required)

Note : Banks may ask for additional documents based on the applicant’s profile. The above list is for reference purposes only.

FREQUENTLY ASKED QUESTIONS

A credit card is a line of credit issued by a bank or lending institution that allows you to make purchases and borrow money up to a preset limit. You'll then receive a monthly statement detailing your charges, which you must pay in full by the due date to avoid interest fees.

A good guideline would be that if your score falls below 750, then it's best not to apply.

You can apply for a credit card online or through the issuing bank/lending platform. The application process typically involves submitting your personal information, income details, and employment history.

Eligibility criteria vary depending on the bank/lending platform but generally include factors like your credit score, income, and employment status.

Approval times can vary, but some lenders offer instant decisions, while others may take several business days.